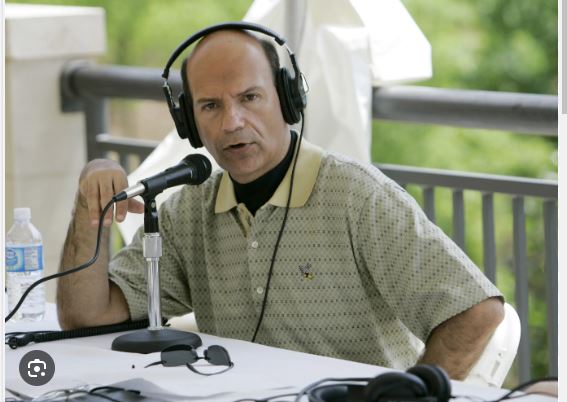

Paul Finebaum sends a strong statement on the ACC and Big 12 admitting Memphis.

Paul Finebaum feels the ACC and Big 12 missed out on Memphis during the most recent round of conference realignment, chastising the conferences for failing to include a school that struck a historic NIL contract with the Tigers on April 19.

“I think (Memphis’s NIL deal) may be one of the most critical pieces ever,” Finebaum told the Memphis Touchdown Club. “From a distance, if you’re in another league and you see one of the most significant organizations in not only the country, but the globe, enter this sector, it must invigorate you. And, to be honest, I think the ACC made a mistake by not selecting Memphis over SMU last year.

“I think the Big 12 made a bigger mistake when they took in Houston and UCF and didn’t come Memphis’s way.”

Finebaum denied acting as a homer against the Tigers since he is from Tennessee. He went on to remark that the program has grown significantly in the last two years.

But is he correct about his assessments?

The ACC and Big 12 perceived greater promise in the Dallas, Houston, and Orlando markets than Memphis.

These gatherings are all about money and sense. When the ACC absorbed SMU, their objective was to expand into the Texas market, taking advantage of the state’s largest media market while also acquiring a past national champion. For the Big 12, adding Houston and UCF meant expanding into Space City and Orlando, Florida.

When comparing those three towns to Memphis, it’s evident that those conferences understood exactly what they were doing. All four cities have NBA franchises, but the Memphis Grizzlies are the least valuable. Sure, the Tigers have a chance to take over the city due to the lack of a professional football club, but with a larger stadium than Houston and UCF, they had equal attendance levels to the former and far lower attendance statistics than the latter in 2022, when they all shared a conference.

There is a stronger argument for SMU to win the ACC over Memphis, but the Mustangs have a longer winning streak and greater fan support than the Tigers. Plus, the DFW market dwarfs Memphis’.

Finebaum may have given the Memphis Touchdown Club lip service here, but the Tigers’ NIL agreement with FedEx makes them a must-see program for the next round of conference realignment.

According to Texas Tech head coach Joey McGuire, we won’t be getting off the college sports league realignment merry-go-round anytime soon.

McGuire asserted during an appearance on 365 Sports on April 26 that conference realignment “is not over,” however he did state that he does not know anything solid and would not divulge it.

“It’s going to be intriguing because, and I don’t know enough about this aspect, but I think that league realignment is not complete,” McGuire said, before adding, “It could be two years, three years, or even next year. But I don’t think you’ve seen enough of the Big 12, Big Ten, and SEC. I believe the three conferences will look quite different. They will most likely appear different within the following year.

Texas Tech may join the SEC in future league realignment.

Greg Swaim, a radio personality, projected that other Big 12 and ACC clubs will join the SEC in the future, including the Red Raiders.

“If the so-called ‘Super Conferences’ begin poaching the Big12 and ACC, it’s (Kansas football) to the B1G along with Notre Dame, UNC, and UVA, while FSU, Clemson, OK State, K-State, and Texas Tech to the SEC,” Swaim said in a blog post. “There will be other B12 and ACC school poaches as well, but at this time please, no wagering!”

Texas Tech is not AAU approved, hence the Red Raiders would never be eligible for the Big Ten. The SEC makes sense from a cultural aspect — Lubbock, Texas is the type of all-in community where “It Just Means More” — and might serve as a replacement for Texas A&M if the Aggies join the B1G, as is speculated.

If McGuire is to be believed, such a leap might occur sooner rather later.